How Elections Impact Physician Portfolios in 2025

Politics are inevitably going to be top of mind in the coming weeks – especially in the current environment of intense partisan rancor. But investors are best served by focusing on the fundamentals.

We recommend investors ignore any short-term volatility around the U.S. election cycle. A resilient U.S. economy and the Fed pivot to rate cuts will likely impact the markets more in 2024 than politics.

The historic performance of stocks during election years also supports the potential opportunity for investors. Stocks historically outperform their long-term average in election years, with the second half of the year typically the strongest.

Here are some reasons why investors are likely to benefit from ignoring any short-term volatility around the election cycle and sticking to their long-term plan.

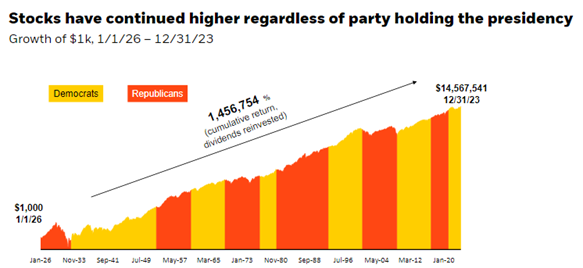

Since 1926, amid repeated shifts of the political landscape, the S&P 500 has produced cumulative returns of 1,456,754%.

Source: Morningstar as of 12/31/23. Stock market represented by the S&P 500 Index from 1/1/70 to 9/30/23 and IA SBBI U.S. large cap stocks index from 1/1/26 to 1/1/70. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

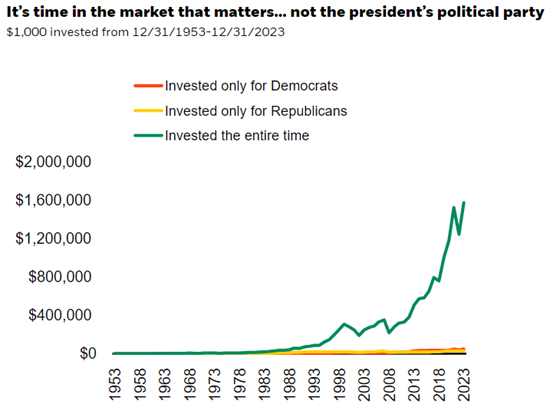

The market’s political agnosticism is also evident on a shorter timeframe: people who stayed invested performed far better than those who only invested when one party was in power. The bottom lines are investing based on political beliefs and have historically led to underperformance compared to staying focused on the long term -- and staying invested.

Source: Morningstar as of 12/31/23. Stock market represented by the S&P 500 Index from 1/1/70 to 12/31/23 and IA SBBI U.S. large cap stocks index from 1/1/54 to 1/1/70. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

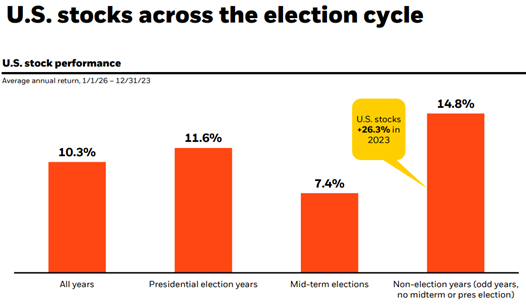

If the market’s long-term performance doesn’t assuage your political concerns, note the returns of stocks during presidential election years. On average, stocks have risen 11.6% during presidential election years since 1926, slightly better than the market’s average 10.3% return in all years.

Morningstar as of 12/31/23. Stock market represented by the S&P 500 Index from 1/1/70 to 12/31/23 and IA SBBI U.S. large cap stocks index from 1/1/26 to 1/1/70. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

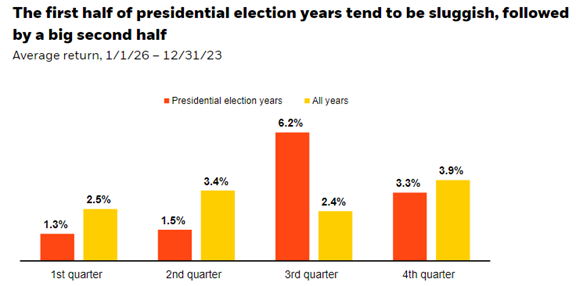

Drilling down further, stocks tend to follow a pattern during presidential election years: sluggish in the first half, followed by a big second half. Historically, the third quarter has delivered the strongest returns, with an average return of 6.2%.

Many Americans have strong feelings – and genuine concerns - about politics, but history suggests that presidential election years tend to be pretty good for stocks, especially in the second half of the year.

Source: Morningstar as of 12/31/23. Stock market represented by the S&P 500 Index from 1/1/70 to 12/31/23 and IA SBBI U.S. large cap stocks index from 1/1/26 to 1/1/70. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

There’s no guarantee the market will follow the historic election year pattern in 2024. And, of course, elections have consequences for fiscal policy, which can affect financial markets. But we believe a combination of the Fed’s pivot and the U.S. economy’s positive momentum make a compelling rationale for investors to stay invested in their long-term diversified portfolios.

Trent Searle is a Certified Financial Planner® and Senior Portfolio Manager with Physician Wealth Advisors (a wholly owned subsidiary of the Utah Medical Association). For over 30 years, the salaried advisors at Physician Wealth Advisors have been working with physician members of the UMA. Their expertise in creating customized retirement plans as well as tailored investment strategies specifically to fit the needs of the medical community has led them to manage over $1.5 Billion of investment assets.

If you would like to see what Physician Wealth Advisors can do for you, please contact our team at questions@pwa.org or at 801-747-0800.